| |

|

Online email | Forward | Unsubscribe |

|

|

|

Join the cherry forums here

(It costs nothing!) |

|

| Advertisement by Equity Release Partners |

Here at Equity Release Partners we understand that identifying potential customers for equity release can be tricky.

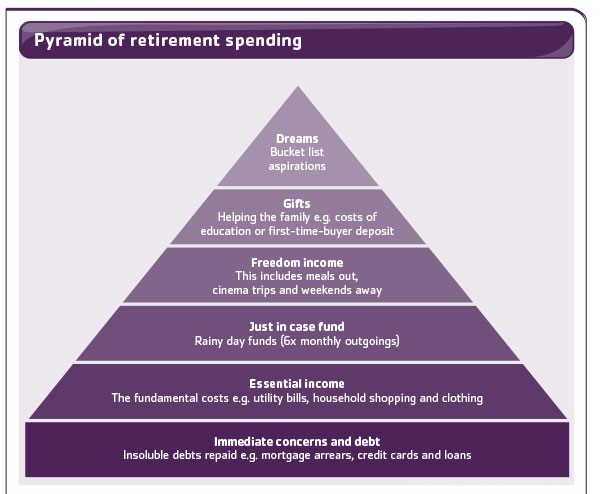

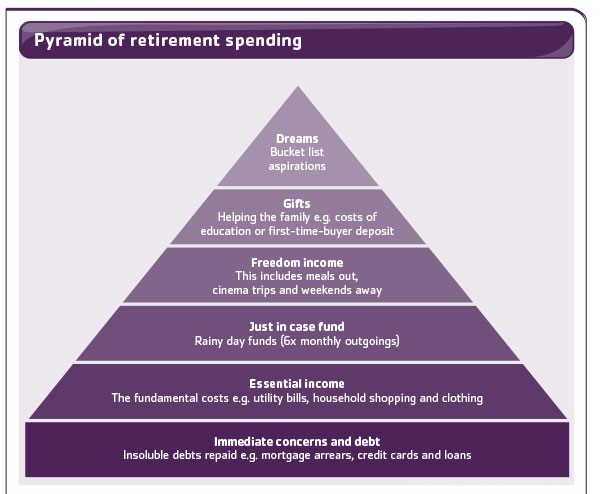

To help with this process, we have identified that it’s important to understand the priorities your clients have for their spending in retirement. The easiest way to visualise this set of priorities is using a retirement pyramid.

The pyramid below illustrates the various building blocks of retirement income/spending needs in order of importance. The 'possible solutions' highlight how equity release schemes could benefit clients in such scenarios. These solutions can therefore provide you with an angle with which to sell the equity release concept to them.

Mark |

|

| Immediate concerns and debt |

|

Situation: At the very base of the pyramid are the

client’s most fundamental needs: the immediate

concerns and debt. Clearance of high cost consumer

debt will usually be their first priority. In addition,

lenders are demanding repayment of their mortgage

book due to age or term reasons. Therefore,

homeowners not wishing to downsize, need to find

alternative repayment vehicles which can be difficult

to find at, or in retirement . |

Possible solution: Dependent upon loan-to-value

ratio’s there could be a solution derived from a lump

sum lifetime mortgage. The maximum a 60-year-old

could release is up to 30.5% of their property value at

a fixed lifetime interest rate of 6.12% (6.35% typical

APR). This plan comes with the option to pay back

up to 10% of the original amount borrowed with no

penalty & require no proof of income. |

| Essential income |

|

Situation: This is the basic income most people

need to cover their day-to-day living costs. This

includes items such as food, clothing, housing bills

and maintenance and running a car. If your client is

struggling to meet these expenses, they would have

to make major adjustments to their finances,

potentially moving to downsize their home. |

Possible solution: For many people at, or in

retirement, moving house can be too stressful after

having been resident for many years. Should they

require additional income to support their budget,

then a drawdown lifetime mortgage could assist,

alleviating the need to move. By taking a small initial

lump sum, followed by further drawdowns as & when

required this can help budgeting significantly. |

| Just in case fund |

|

Situation: Strictly speaking this is an emergency fund

which behaves ‘statically’ rather than part of a client’s

income and expenditure. However, most clients are

keen to maintain this “just in case” fund which should

cover around six months’ worth of essential income

needs and usually kept as cash savings. |

Possible solution: The key to successful equity

release advice is to recommend the client only takes

what they need to spend over the first 12 months. By

not having too much savings in the bank at the

expense of taking equity from their property is best

practice given the low rates of interest currently. |

| Freedom income |

|

Situation: Once a comfortable retirement income has

been established to meet daily living expenses, clients

may wish to consider the “freedom” of disposable

expenditure. This may reflect the level of income and

expenditure they have become used to in the years

leading up to retirement. It should be noted that people

have different perspectives on spending levels & can

vary significantly. |

Possible solution: Advice should always be tailored

to an individual’s needs and lifetime mortgages are

no different. Where disposable income is significant,

then retirement products could be considered if proof

of income is no problem. Therefore, lower interest

rates and reduced longevity in contract along with

early repayment charges could be achieved. |

| Gifts |

|

Situation: With mostly increasing levels of equity tied

up their property, parents may wish to help family

members. An early inheritance may allow them to

assist younger relatives with education costs, getting

onto the housing ladder or setting up in business.

Some clients may also wish to make significant

charitable donations or use as a tool towards

inheritance tax mitigation. |

Possible solution: Assuming a specific amount is

required to help relatives, then interest rate can

usually be the most important factor in the

recommendation of a lifetime mortgage. During 2015

we have seen the lowest rates on record with sub 5%

fixed lifetime interest rates available. Currently, the

market is in a period of innovation & competition, so

hopefully we’ll see more competitive rates into 2016. |

| Dreams |

|

Situation: At the top of the pyramid are the dream

purchases and spending. These could be high cost

holidays such as cruises, expensive cars or second

homes that often reflect life-long dreams of clients.

There comes a point in life where all that hard work

and bringing up the family should pay its rewards! |

Possible solution: Intentional one-off purchases

would usually be satisfied via a single lump sum

lifetime mortgage product with no frills; just the lowest

rate needed. This may encompass a fixed early

repayment charge period, should the client eventually

downsize and want the option to it pay off completely. |

Click to use your free

Equity Release Tools |

|

|

|

We've created these handy tools on our website for you to use and help generate equity release referrals with your clients.

Once registered, you will also have access to a suite of marketing materials & downloads. |

Issued for use with intermediaries. Information not approved for use with customers

|

|

Unsubscribe from ALL cherry emails

Cherry and cherryFind are our trading names ('cherry') Registered Office: The Stables, Little Coldharbour Farm, Tong Lane, Lamberhurst, Tunbridge Wells, Kent TN3 8AD. Registered in England and Wales. Company Registration Number: 05624666. VAT Number: 874593966

DISCLAIMER - Please note that cherry never recommends the products or services of other companies and in making contact with, or accepting contact, products, services or advice from any individual, company or adviser, you agree, without exception, that no accountability in respect of resultant damages, incurred by you or by others, rest in any way with us.

7622 / 19.11.15

Unsubscribe from ALL cherry emails |

| |

|