You are here:

Anonymous

Joined Anonymous

Posts Anonymous

BEAT THE QUEUES

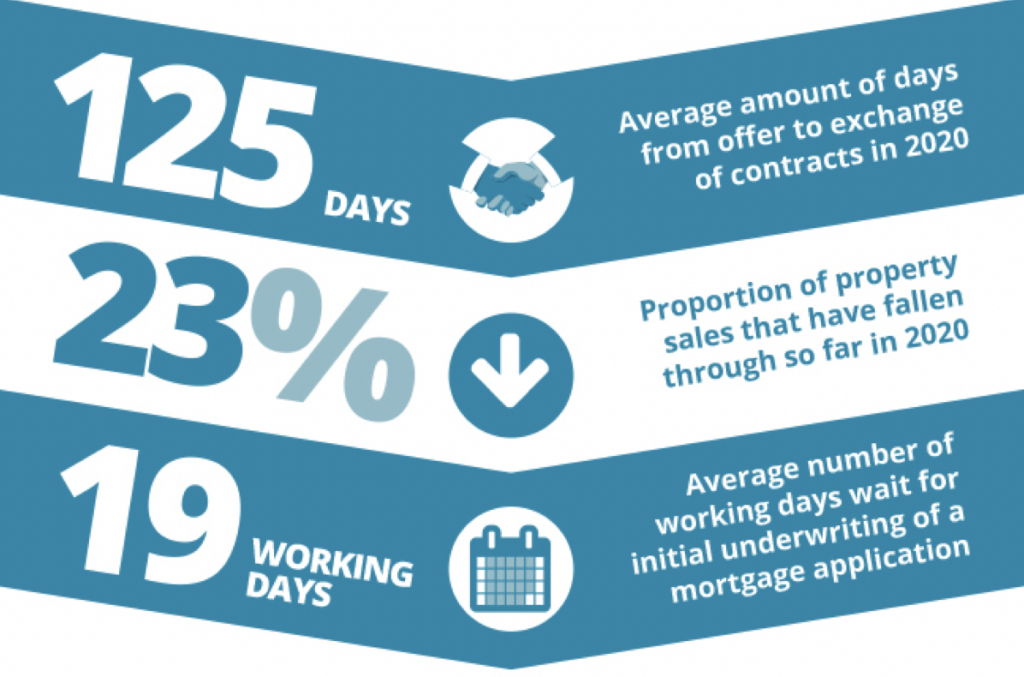

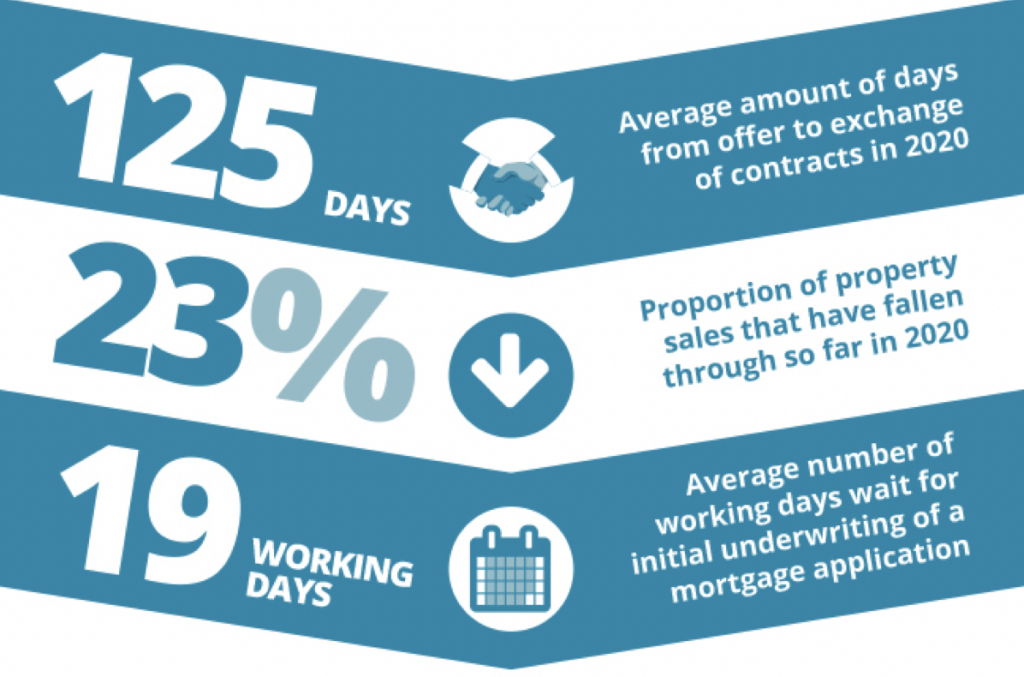

The current mortgage market may be at an all-time high for transactions but the process of buying and selling is leaving brokers frustrated...

BRIDGING FINANCE

MAY BE THE ANSWER...

Break a chain, re-finance or extend the time needed for sale. Short-term Bridging is flexible and generally quicker to arrange than a standard mortgage.

*LIMITED TIME ONLY - RATES TO MIRROR YOUR LTV*

Crystal Specialist Finance has access to a limited time regulated bridging product that allows a lower rate when matching to the loan to value.

Bridging Finance

Rates from 0.45% per month

Up to 75% LTV (dependent on location)

For residential properties

UK individuals & companies

First charge only

Habitable or light refurb

Max Loan: £2,000,000

Non-Regulated Bridging also available

Bridging finance can be complex but that is why we’re here. Our expert team is here to make this easily accessible to you and your client.

MAKING

SPECIALIST FINANCE

#CRYSTALCLEAR

Speak to our award-winning team

01827 301 070

or visit our website

AVERAGE COMMISSION PAID TO BROKERS

£3,000 FOR BRIDGING

PER COMPLETED CASE

|

|

This assumes a £200k loan and 1.5% commission is payable to the broker for Bridging. Actual commission is subject to the lender selected

|

Send to a friend

Send to a friend