Report topic or post

If you feel like the content shown below has broken cherry's rules, please click the "Report to cherry" button at the bottom to let us know why.

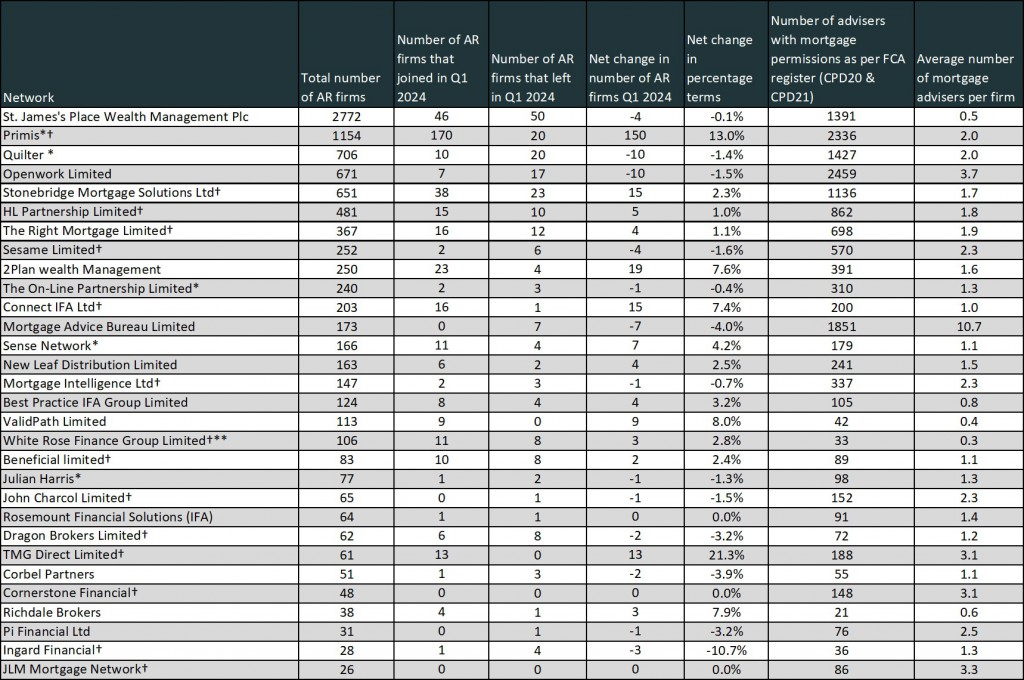

For detail regarding this table, please read the accompanying copy beneath the table or visit www.network-consulting.co.uk for more information on how it is put together

Q1 2024 NETWORK ROUND UP

The network league table illustrates total Appointed Representative (AR) firm numbers for networks prevalent in the mortgage market, the movements in firm numbers for the first quarter of 2024, along with current adviser numbers holding mortgage permissions.

The most noticeable point revealed by the table for the Q1 this year is the apparent huge increase of 170 AR firms joining Primis. However, the reason for this is simply explained. 153 of these firms are attributed to the completion LSL’s purchase of TenetLime, adding them to the Primis trading style, which now includes four brands. If we discount the wholesale migration of these firms, then Primis experienced a minor net loss of 3 firms for Q1.

Readers that follow the network league table will note the complete omission of Tenet as a network entry. With the sale of Tenet network AR’s finally completing, means that virtually all the AR firms and advisers within the other Tenet brands have now moved over to either 2Plan or Openwork. According to the FCA register, the Tenet owned AR firms, TFS and TMS are now dual authorised with Openwork, presumably as part of a full transition pending. If this is the case, it would leave Tenet with two AR firms remaining, one of which they own. If these two firms also migrate as part of the sale, it will only leave the group with their compliance support service TCS, assuming they don’t have plans sell this too. It looks very much like this quarter should finally draw a line under the sad exit of one of the longest standing and formally largest networks.

The other major talking point is the purchase of John Charcol by Pivotal Growth, which was announced in Mortgage Strategy on the 4th April and makes this their eleventh acquisition to date. Pivotal Growth is a joint venture with a private equity firm, Pollen Steet Capital and LSL, which makes one wonder what LSL’s grand plan is and what other companies may be in their sights.

The net growth in AR firms experienced in Q4 of 2023 continued its trend in to the first quarter this year, with 53 more firms joining than leaving networks that are included in the table.

Adviser numbers (with mortgage permissions) remains steady amongst the top networks, only reducing by 80 from the figure we published for the end of 2023. This equates to an insignificant reduction of less than 0.5%. The figures also take account of Sandringham and Envelop networks no longer being included in the data as their AR’s numbers are less than 20 firms.

Other than Primis growing to a huge 1154 firms, networks with notable growth this quarter are, Stonebridge with a net growth of 15 AR’s (2.3%), and once again TMG, with a net growth of 13 firms (21.3%).

Rumours remain of further consolidation and acquisitions within mortgage distribution, but there is no solid information to corroborate this, so this holds little credibility at present. However, there are definitely growth plans of the “smaller” networks, equally with entities that don’t currently appear on the table but may well do in the near future as they break the 20 AR firm number.