Mortgage Brain sees ESIS volumes grow by 11.5%

03 June 2020

- Fifth consecutive week of increased ESIS volumes, up11.5%* on last week

- Product numbers up 2.2% to 8,635

- Product mix returns to pre-pandemic levels

UK, June 03 2020: Mortgage technology expert Mortgage Brain has seen ESIS volumes produced by its sourcing systems rise 11.5%* over the last week, continuing its recent resurgence.

This is the fifth straight week in which volumes have risen, with numbers growing by 27.7%* since the housing market formally reopened three weeks ago. ESIS volumes are also up by 43.7%* on the lowest point seen in the week ending 26th April, but are still down on the nine-week average to 16th March by 23.7%. (*Note: the figures have been adjusted to take into account the May Bank Holiday)

Mortgage product numbers have now risen for four consecutive weeks, increasing by 2.2% last week to reach a total of 8,635. Notably the return of higher LTV lending and the opening up of the homebuying market have been significant drivers in this increase, with purchase products accounting for 85% of the rise. While product numbers are now up by 16.3% on the pandemic low point seen in the week ending 12th April, they remain down by 41.2% on the nine-week average to 16th March.

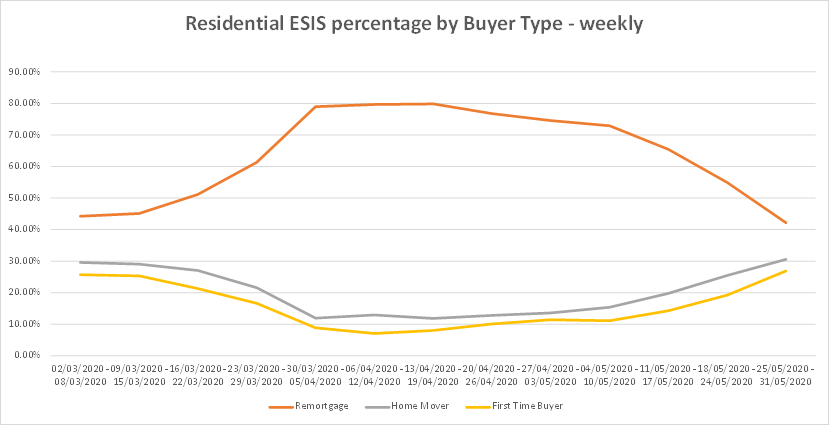

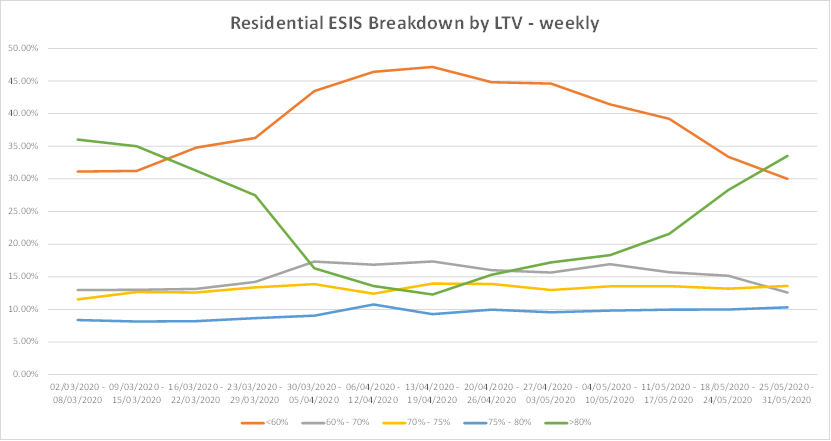

Mortgage Brain data also reveals that the breakdown of the types of mortgage being taken out is returning to pre-pandemic levels. On residential lending, homemover and first-time buyer borrowing now accounts for 57.5% of business, having increased by 12.8% over the last week, with remortgaging accounting for the remainder. This is the sort of breakdown seen before the pandemic hit the UK. It is mirrored on the LTV front too, with lending at below 60% LTV dropping to 30% of business, while lending above 80% LTV has grown to represent 33.5% of business, both of which are around the levels seen pre-pandemic. However, lending at above 90% LTV represents just 1.4% of business, down from the 6.6% levels seen a few months ago.

Mark Lofthouse, CEO at Mortgage Brain, said: “There is more cause for optimism at the moment, with ESIS volumes up strikingly since the housing market reopened its doors just a few weeks ago. Purchase lending has swiftly recovered to account for a similar proportion of business as before the pandemic demonstrates that there is still a keen desire among would-be homebuyers to get on with moving up or down the ladder.

“But it remains extremely early days in this recovery. While we have now seen sustained improvements in the numbers of products available, they remain substantially down on pre-pandemic levels as lenders gradually adjust to the new world. While there is good reason to feel positive about the direction the market is heading in, progress looks likely to remain slow and steady for some time to come and it remains to be seen whether these business levels are sustainable.”

*(Note: the figures have been adjusted to take into account the May Bank Holiday)