Over half of Brits expect to inherit a property in their lifetime – but it’s definitely not a free home

19 January 2023

Inheriting a home in 2023 will come with a bill of £20k on average – and that doesn’t even include inheritance tax

Over half of UK adults (58%) expect to inherit at least one residential property during their lifetime, but most (64%) couldn’t cover the high associated costs without taking out a loan.

According to new research, which included a poll 2,000 adults, by the Probate Lending experts at Tower Street Finance, Brits that are left a property in a Will this year should expect a bill of around £20,000 – and that doesn’t even include inheritance tax.

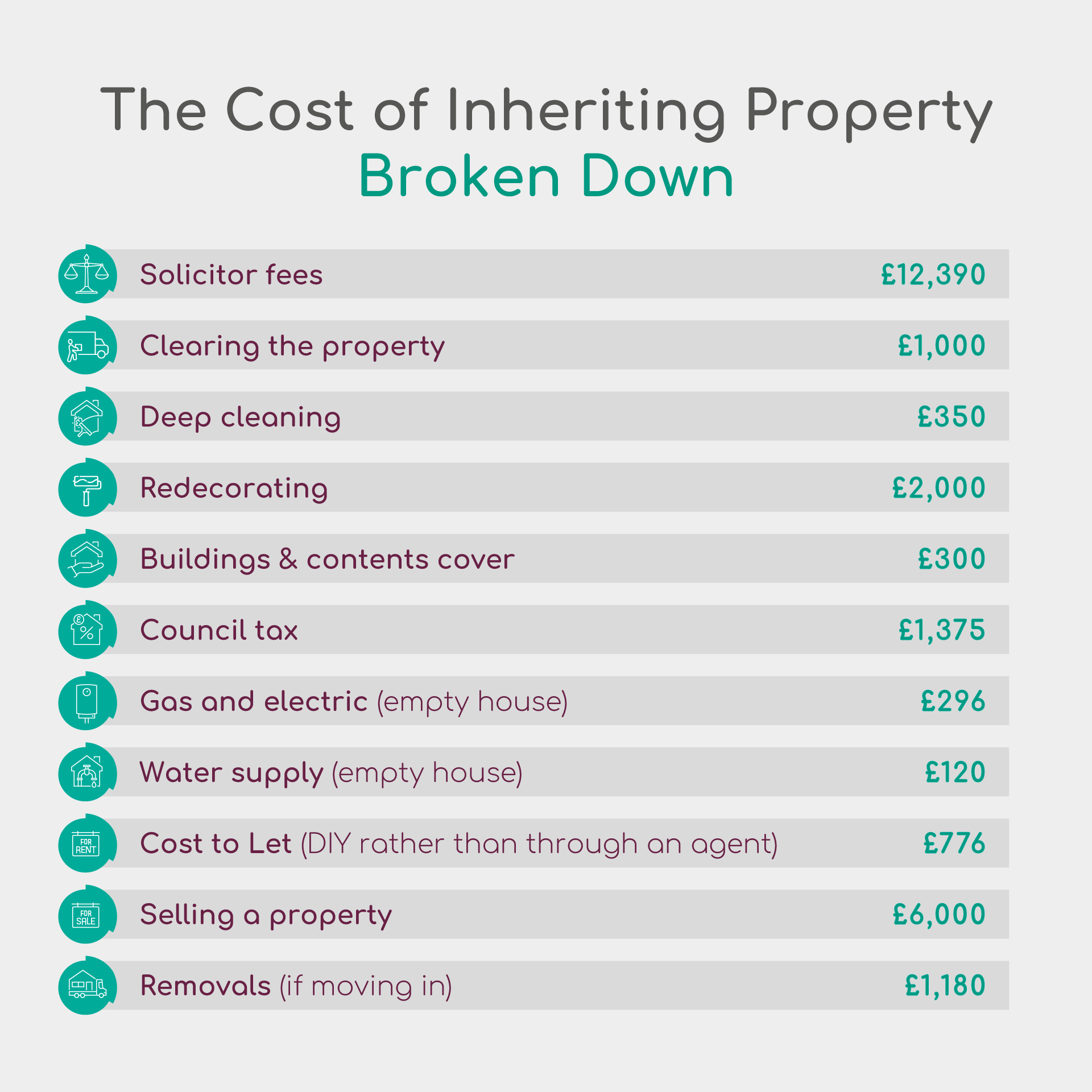

This cost - which is expected to rise over time - is made up of expenses such as house clearing, basic redecorating, standing charges for energy and water, insurance and solicitors' fees.

It varies slightly depending on what the new owner decides to do with it.

If left a property in a family member’s Will (in the next 12 months), 39% said they would sell it, while 34% would keep it (and either live in it themselves or rent it out).

- Cost to inherit a property (excluding inheritance tax) and put it on the market for sale: £23,800

- Cost to inherit a property (excluding inheritance tax) and move into it: £19,000

- Cost to inherit a property (excluding inheritance tax) and get it ready to let: £18,600

Anyone who is prepared and able to do work themselves, or shop around, could also reduce some of these costs.

Solicitor’s fees are usually the largest expense, averaging around £12k. However, experts advise that using a solicitor to manage the legal process is essential.

Clearing the property, deep cleaning it and decorating it (painting only) costs around £2,800 on average for a typical home too, but of course this can be a lot more depending on the work that is needed – with structural work, rewiring and bathroom and kitchen renovations often costs significantly over this estimate.

Even those who plan to sell the home without doing anything to it shouldn’t expect to avoid some bills, as an empty property comes with costs too – insurance, council tax, and standing charges for utilities (gas, electrics and water) will all apply, costing around £2,000 for the average home.

Despite these hefty costs, with the current average UK property price sitting at £296,000, being left a home is likely to be a very welcome discovery – especially amongst under 35s who are the most likely to be relying on inheritance to get onto the property ladder (16%).

However, according to the study, many (34%) are unaware of what the process is for receiving their inheritance, how long it could take for them to get the keys (36% expect it to take fewer than six months whereas the typical wait is 9-12 months) or even if they could also be liable for inheritance tax (24%).

Dicky Davies, Founder and Business Development Director at Tower Street Finance added: “A home is typically the most valuable asset we own in our lifetime, and so being left one in a Will is of course a great privilege. That said, it certainly doesn’t come without its challenges and costs.

Typically, properties are left to children or grandchildren, and according to HMRC reports, homes make up 54% of the average estate value total at death.

What’s more, around a third of estates (that include a property) break the inheritance tax threshold - meaning that many will face another bill to cover this, on top of things like solicitors’ fees, clearing costs and insurance.”

For further information about this research please visit: https://towerstreetfinance.co.uk/the-true-cost-of-inheriting-property-in-2023/.