We’ve improved our Buy to Let (BTL) Loan to Values (LTVs)

12 March 2025

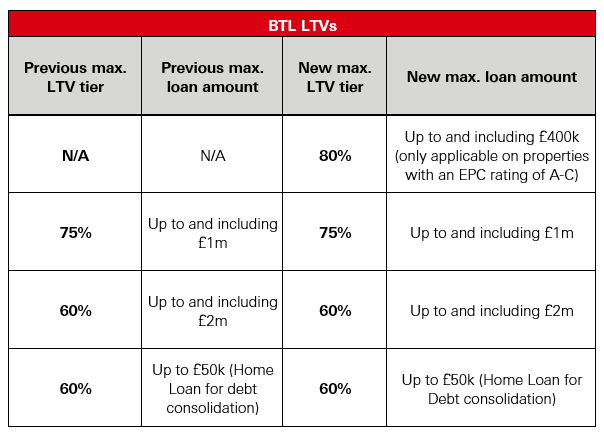

Good news – with immediate effect, we’ve made the following enhancements to our domestic BTL LTVs:

Please note, that the policy limit of 80% LTV cannot be exceeded by capitalising the booking fee.

The above changes are also applicable to Let to Buy (LTB) applications.

Our broker website will be updated shortly with the above changes.

Foreign Nationals criteria reminder

We recently changed our Foreign National lending policy:

- Where any applicant is a UK National or Foreign National with Indefinite Leave to Remain (ILR), Standard lending criteria applies, up to 95% LTV. Visa evidence will still be required for all Foreign National customers.

- Any application(s) that does not fit the above criteria, the following new criteria will apply:

- Applicant(s) has an ‘acceptable’ visa type

- Max LTV increased from 75% to 85%

- Applicant(s) has lived in the UK for at least 12 months, OR

- Applicant has a minimum income of £75,000 per annum or a joint income of £100,000 per annum (excluding variable income)

- There is no longer a requirement for a Foreign National without ILR to have 1 year remaining on their visa (as long as they have an ‘acceptable’ visa type)

- We will now accept debt consolidation applications (subject to our Standard lending criteria).

Please note, we still require the following additional supporting documents for all Foreign National customers who have lived in the UK less than 12 months:

- Credit report from the previous country of residence

- Latest three months bank statements

- Three months payslips.

Further information

HSBC UK

Talk to us using Live Chat, call our Broker Support Team on 0345 600 5847 (Monday to Friday, 9am to 5pm) or contact your local BDM.