Stonebridge: mortgage affordability weakens for second consecutive month

21 March 2025

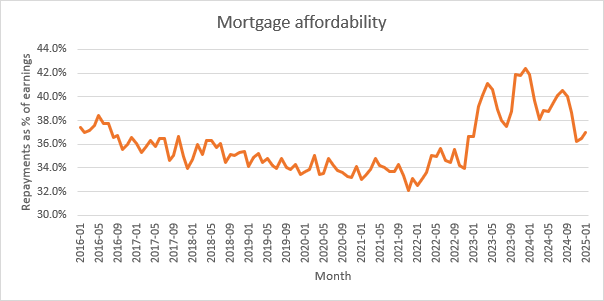

Mortgage affordability weakened for the second month in a row in January, new analysis from mortgage and protection network Stonebridge reveals.

The firm’s latest bi-monthly Mortgage Affordability Index reveals that borrowers spent more of their salary on monthly repayments in both December and January than in previous months.

In December, mortgage repayments accounted for 36.5% of the average borrower’s salary, up from 36.3% in November. This figure increased again to 37% in January, meaning affordability has deteriorated for the second month running.

The decline in affordability is largely down to the combination of increasing loan sizes, slow wage growth and rising mortgage rates.

Stonebridge’s data shows the average loan size grew 1.4% to £192,114 in January, while the average annual salary ticked up 0.5% between December and January, according to the Office for National Statistics.

The average rate on new mortgages increased for the first time in five months, rising 4 basis points to 4.51%, according to loan data from the Bank of England.

However, affordability is still significantly better than it was in December 2023, when mortgage repayments accounted for 42.4% of the average salary. The long-running average is 35.9%.

Stonebridge’s Mortgage Affordability Index combines official wage and mortgage rate statistics with its own loan data to determine the relative affordability of mortgage finance in proportion to the average borrower’s earnings.

Stonebridge is one of the largest independent mortgage and protection networks in the UK, arranging more than £12 billion of mortgage lending each year.

Rob Clifford, Chief Executive at Stonebridge, commented:

“Mortgage affordability has continued to be tight for the second consecutive month as rising house prices push loan sizes higher and mortgage rates edged up. But in context, remember that affordability remains significantly better than at the start of last year, and affordability will definitely improve as rates fall in coming months.”

“While the Bank of England’s Monetary Policy Committee opted to hold rates in May, there are mounting calls for it to reduce borrowing costs further.

“Inflation remains a concern, but much of the recent increase is imported, driven by rising energy costs and a strong dollar rather than by surging domestic demand. As a result, the risk of inflation spiralling out of control again appears limited.

“At the same time, the UK economy is struggling for momentum. If growth continues to stall, the MPC may have little choice but to step in to provide support. That could lead to lower borrowing costs in the months ahead, offering much-needed relief to mortgage borrowers, who are still grappling with the impact of the cost-of-living crisis."

Stonebridge’s Mortgage Affordability Index:

|

Month |

Mortgage repayments as % of salary |

|

January 24 |

41.9% |

|

February 24 |

39.7% |

|

March 24 |

38.1% |

|

April 24 |

38.8% |

|

May 24 |

38.8% |

|

June 24 |

39.6% |

|

July 24 |

40.1% |

|

August 24 |

40.5% |

|

September 24 |

40.0% |

|

October 24 |

38.7% |

|

November 24 |

36.3% |

|

December 24 |

36.5% |

|

January 25 |

37% |

|

Long-running average |

35.9% |