Santander becomes first lender to reduce mortgage affordability rates to enable customers to borrow more

28 March 2025

From today (Friday 28 March) customers looking to purchase or remortgage a home can borrow more from Santander UK. It becomes the first major lender to reduce residential affordability rates in response to the FCA’s call earlier this month for lenders to design their affordability rates to best meet their customers’ needs, in a market where interest rates are declining.

All residential affordability rates have been reduced by up to 0.75%, bringing them to the lowest levels since 2022.

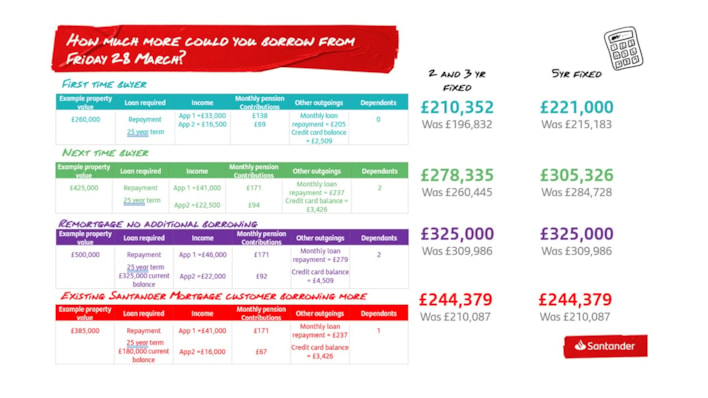

In real terms, this means that many customers applying for a residential mortgage from Santander UK can now borrow between £10,000-£35,000 more than yesterday, depending on their individual circumstances and subject to affordability checks and loan to income limits.

David Morris, Head of Homes, Santander UK said:

“Helping customers achieve their homeownership dream is a key priority for Santander, but we know that affordability constraints continue to bite. We’re thrilled to be the first major lender to respond to the updated FCA guidance, alongside introducing a range of reduced mortgage interest rates today, fulfilling our role as a responsible lender while helping more customers to borrow what they need to release their home aspirations.”

*Source Santander UK, the above examples are illustrations only and mortgage affordability is assessed on an individual basis.

On Wednesday, Santander UK announced a new range of mortgage products with rate reductions of up to 0.15% for home movers and up to 0.08% for first-time buyers. More details on the new range can be found here.