Beginner’s Guide to Building Credit the Right Way

A good credit score is of the utmost importance if you ever plan on making a major purchase in life—buying a house, renting a flat, getting a car loan, or even buying a smartphone. There’s no two ways about it: you need to have a good credit score; and the sooner you start building it properly, the easier you’ll find making important purchases in the future. It’s generally a good idea to start building credit in early adulthood by closely managing your spending.

Building credit is a long-term process, taking years to achieve a satisfactory credit score. Your credit score is a number that essentially represents how well you manage your money, taking into account how much money you borrow, how much you pay back, and how quickly you are able to do it.

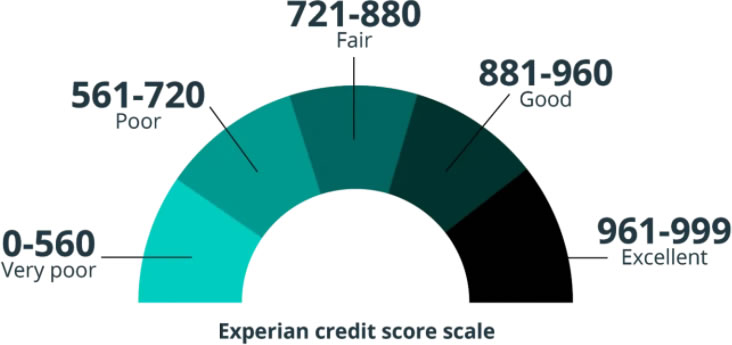

There are three main credit rating agencies in the UK: Experian, Equifax and TransUnion. They analyse your spending using credit card bills, loans, etc. and assign you a numbered credit score: the higher it is, the more reliable you have been deemed. Experian, for example, uses a scale of 0-999.

Here are some tips to get you on the road to building credit.

Background: 3 Updated U.K. Credit Score Statistics in 2020

- Knowledge is power: data from Experian suggests that a majority of UK residents are not accessing their credit report.

- Average credit scores by age reveals that residents in Cardiff and Belfast are slower to start building credit than Edinburgh and London.

How to Start Building Credit the Right Way

Building credit from scratch is much easier than improving an established, bad credit score. So if you have yet to establish yourself, here are some helpful tips:

1. Apply for a credit card. Weigh up your options and open a credit card from your local bank, preferably a secured credit card, or one without annual fees. Each bank has different offerings and stipulations for opening a line of credit, so make sure that you’re fully aware of what you’re getting yourself into. Don’t start running a race you can’t win, and don’t open a credit card if the stipulations make it hard to manage.

2. Keep credit cards balances relatively low. Keep very close track of how much you spend each month with your credit card and ensure you are able to pay the full balance each month. This is most easily done by paying for 1 or 2 monthly bills using a credit card or by using it for regular, small purchases such as petrol money. Banks and lenders know that people who maximise their credit limit have problems paying it back within the month, so continually spending even close to your limit will raise some red flags and hurt you in the long run.

3. Pay bills on time every time. Your credit score will suffer if you have overdue bills of any kind, including credit card bills, student loans, overdraft fees, rent, utility bills, and more. Your credit card isn’t permission to spend carelessly on big ticket items. If you can’t afford to buy it in the moment, then you can’t afford to buy it at all. There is a big difference between being able to buy something and being able to afford it. Using your credit card to buy something today that you can’t afford is a quick way to go into debt and ruin your credit score.

4. Keep old bank accounts open. Having a long track record of trustworthy credit contributes massively to your credit score. By leaving your old accounts open, you are showing that you have a history of responsible spending. Closed bank accounts will eventually be dropped from your credit report entirely.

5. Get on the electoral register. By registering to vote, you are officially confirming that you are who you say you are, and lenders use that information to prevent identity theft. Having your electoral register information available to lenders will make them more confident in lending you money.

6. Monitor your credit score. Sign up for a free credit monitoring service to receive alerts of important changes. This will help you avoid cases of identity theft as well as keep you on the right track spending-wise. Just keep in mind that requesting your credit report will often cause a temporary dip in your score, so check in sparingly!

How to Fix a Bad Credit Score

A bad credit score can impact many aspects of your life. It can prevent you from securing a rental property, car, other loans, security deposits for utilities, mobile phone contracts, and even employment. As we mentioned above, it is much easier to build good credit from scratch than to recover it from the pit of bad credit. But it isn’t impossible. It will just require some knowledge, discipline and time. It can take up to 6 years to achieve your ideal score, so the sooner you start, the better.

- Check your credit report to identify your financial shortcomings. Do you spend too much on your credit card? Do you miss bill payments? Are there errors on your report? All of these and more have the ability to severely damage your score.

- Check your report for errors. Correct any outdated information, ensure all of your accounts are accounted for, and look out for any fraudulent activity. Proactively ensuring your information is up-to-date will help give your credit a boost.

- Pay your bills on time. Payment history is one of your credit score’s largest factors. Being forgetful is not an excuse, so set up standing orders on as many accounts as you can. If multiple bills are owed on the same day and you have trouble paying them all at once, contact your account administrator and see if you can change the payment date to keep your debts spread out throughout the month.

This includes but isn’t limited to:

- Credit card bills

- Internet/landline bills

- Mobile phone bills

- Utility bills

- Rent

- Student loans

- Pay off existing debts. If you have credit card balances, stop using that card and start chipping away at paying off those debts. Start with the card(s) that have the highest interest rate, and work your way down. Existing debts is the 2nd largest factor in your credit score.

- Do not apply for new lines of credit. When applying for new loans or credit cards, lenders check your credit history, which can temporarily decrease your score — especially if you’ve been frequently attempting to borrow money from many different sources.

- Find a guarantor A guarantor is somebody with good credit that consigns on your loan or line of credit, essentially reassuring the lender that two people are now responsible for the debt instead of one.

Should I Use a Credit Card to Start Building Credit?

Credit cards are an essential tool for building credit and having multiple might be helpful in fast tracking the credit building process; however, proceed with caution. Credit cards are ideal for lower borrowing amounts that can be repaid over several months, but it’s important to make payments on time. Making a plan to pay each statement in full before the due date is the only way to avoid accruing interest. Additionally, credit cards offer a revolving line of credit which is a component that contributes to credit scores. Credit cards are best suited for needs that are not urgent, but handy in case of minor emergencies.

Key Considerations for Responsible Credit Card Use

- Use your credit card, don’t open an account and just let it sit there

- Don’t max out your credit card and take care not to exceed approximately 10% of your available credit

- If you can pay off the amount due before the end of the statement closing date, do

- Pay on time, every time

- Consider making multiple smaller payments per month to show responsible borrowing activity

While your credit score is composed of several factors, if you make several mistakes they can add up and negatively impact your credit score. For example, multiple missed credit card payments, too many hard inquiries because you’ve applied for too many lines of credit at once, and a high credit utilisation are just a few mistakes that can be detrimental to building a healthy credit score. Do not let credit card horror stories bear weight on your decision to use them as a means of building a robust credit history. When used responsibly, credit cards are a great tool in your financial toolbox that can put you on the fast track to financial freedom.

6 Things That Can Impact Your Credit Score

1. Inconsistent payment history.

An inconsistent payment history is an important element used to calculate credit scores. Lenders are hesitant to approve loans when they aren’t confident that they will get their money back and on time. If you regularly fall late on making payments, that signals to lenders that you’re not financially responsible.

The easiest way to stay on time with payments is by setting up a direct debit with your banking institution so your bill is automatically charged before the deadline.

2. Using too much of your available credit.

Available credit is the total amount of credit on all of your accounts, credit cards included. Using too much of your available credit could lead to an imbalanced debt-to-credit ratio. When a lender is reviewing your credit history they will examine the total amount of credit you have divided by the total amount of debt you have and come up with a credit utilisation ratio. A high credit utilisation ratio, for example anything above ~30%, could negatively impact your overall credit score.

3. Short credit history.

By nature, younger individuals start from the bottom and must work towards building credit. For example, a university student just striking out on their own will not have a long credit history. The key is to be financially responsible and to be proactive with building credit. Start building credit right away, whether through a credit card, on time student loan payments, or through a personal loan.

4. Too many revolving accounts.

If you think you have too many credits cards, you just might. While there is no specific number that is considered too many (because everyone’s credit journey is unique), opening multiple lines of credit especially during the same time period can lower your credit score. Consider your financial situation before making rash decisions to close accounts completely though, because that could also cause your score to dip. If you find yourself in this situation, determine your credit utilisation ratio and find out if you can actually pay the debts you’re racking up when they’re due. This will help you figure out your next course of action.

Credit age is also something to keep in mind. The only way to increase your “age” is to keep old accounts open and in good standing for a long period of time and avoid opening new ones excessively. Every time you open a new credit card or take out a new loan, your average age decreases. So, if you remain patient and keep things in order, your score may increase on its own.

5. Poor mix of credit.

Ideally your credit history would include a diverse mix of types of credit, like revolving accounts and instalment loans. Having a healthy mix of both types makes you more attractive to lenders because it signals that you’re able to manage different types of credit. This is especially important when you go to purchase your first home. Lenders are more comfortable approving loans to those who have successfully managed both.

Fun fact: Risky payday loans and logbook loans don’t count into the healthy credit mix.

6. Joint Loan Agreements.

If you’ve entered into a joint loan agreement, the other person’s credit rating and risky financial behaviour could impact your credit score. For example, if the other person has missed payments, this can decrease your credit score. Be sure all joint accounts are closed if you no longer have a relationship with the other person. You should also contact the credit reference agency to ask for a ‘notice of disassociation’ to ensure your credit files are unlinked.

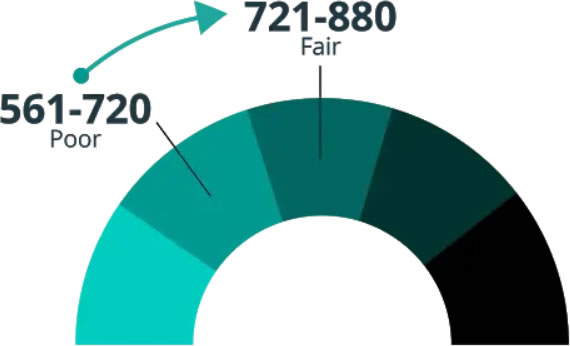

New analysis from Experian estimates that the APR offered on a loan could fall by at least 2% on average when someone improves their score by just one Experian credit score band.**

That means if an individual improves their score band from Poor to Fair, they could save an average of £381 on a 4-year loan of £6,000, as they would likely be paying a lower interest rate.

How Long Does it Take to Start Building Credit?

There are many factors that go into the length of time it takes to build credit as each person’s financial history and spending habits are unique. Building credit the right way takes time and it’s not uncommon for it to take 6 months to a year before you see any benefit to your credit score if you’re starting from scratch. Additionally, any major mistakes like missing multiple payments or exceeding credit limits can be disastrous and stay on credit reports for up to 6 years—impeding the credit building process.

What If My Credit History Isn’t in the UK?

Credit scores don’t carry over from overseas. So if you’ve recently moved to the UK, you are essentially starting your credit building journey from scratch. UK credit agencies like Experian, Equifax and Transunion use UK accounts to determine credit scores. Keep in mind that the debts you had overseas will count against you if left unpaid. You can’t run from creditors.

Below we’ve listed out what you will need to do in order to begin your UK credit building journey.

1. Contact Your Financial Institutions

If you have newly established credit overseas and are moving to the UK, check with your current financial institutions to see if they can transfer your bank accounts and credit card accounts to the UK. This is something certain companies can accommodate if they have an existing footprint in the UK.

2. Open a UK Bank Account if Existing Accounts Cannot Transfer

To open a bank account with one of the larger UK financial institutions you will need to arrange an in-person appointment and provide the following information:

- Passport

- Biometric Residence Permit (required if you’re on a UK visa)

- Employment letter

- Proof of UK address

- Letter from your current bank overseas (depending on the bank)

3. Get a UK Address

As an expat you cannot obtain a UK credit score until you have 3 years of address history in the UK. When you do find a place to live, it’s also important that you do not move excessively during that 3 year time period. Lenders are apprehensive to approve loans to someone who has moved repeatedly during a short time frame.

4. Speak with Lenders Directly

If you have a decent history overseas, speak to UK lenders and request they look at your past credit history. While it doesn’t directly figure into your UK credit score, the ability to show that you have a record of on time payments makes a stronger case for loan approval. Obviously you’re at the whim of the lender whether or not they decide to review it, but it can only help you.

5. Get on the Electoral Role (if Possible)

Registering to vote in the UK can boost your credit score within approximately 30 days. Of course, you have to be a UK citizen to be able to vote. There are different ways to apply for British citizenship based on your circumstances and you can learn more about becoming a British citizen here. If you are not ready to begin this process, you should add a Notice of Correction to your credit report.

6. Get a Credit Card

Open a credit card from your local bank and preferably one without annual fees. Begin using the card regularly and pay on time every time to gradually build your UK credit score.

Find out more here - https://blog.portify.co/beginners-guide-to-building-credit-the-right-way/

Published: 22 October 2020